Flood Insurance I’ve often wondered about my hometown, Springville UT, since I’ve heard of a flood that happened decades ago when hobble creek (a creek which runs through the middle of the town) overflowed and flooded most of the town. If I owned a home in Springville, would I be required to purchase flood insurance? Read More »... Read more ›

- box,

- box home loans,

- flood insurance,

- home insurance,

- home loan,

- mortgage,

- when is flood insurance required,

- why is flood insurance required

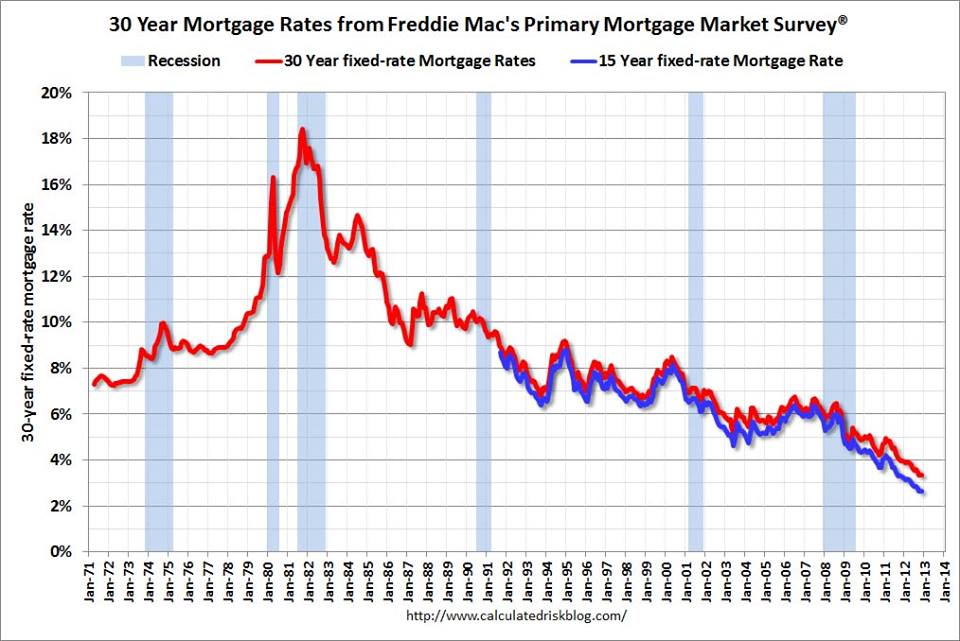

Considering a Refinance? In the 1980’s and 1990’s interest rates of 8-10% were commonplace. Over the years’ rates have dropped, and in 2012 we saw rates go as low as 3.35% and lower in some cases. What if you kept that rate of 10%, and never took advantage of the opportunity to lower it? You would have Read More »... Read more ›

- box,

- box home loans,

- box loans,

- box refi,

- box refinance,

- check todays rates,

- home equity,

- home loans,

- interest rates,

- low interest rates,

- mortgage,

- rate quotes,

- refi,

- refi rates,

- refi tips,

- refinance,

- refinance rates,

- todays rates,

- when should i refi

Mortgage Escrow Prepaids include: We wish (like you) that escrow funds from a previous mortgage could simply be ‘rolled over’ into your new m escrow account, but unfortunately it doesn’t work that way anymore ever since the Dodd/Frank Act took effect. Understanding mortgage escrow prepaids can be tricky… but we’ll help you get a better understanding, Read more ›

- box,

- box home loans,

- dodd frank,

- dodd frank act,

- escrow,

- escrow prepaids,

- home loans,

- mortgage,

- mortgage tips,

- prepaid items,

- prepaids,

- understanding mortgage escrow

Credit Scores & Your Financial Health So we hear a lot about this infamous score and how it can affect our future financial abilities – but what is it really, and how does it come about? First of all, a credit score is an entirely different beast than a credit report. A credit report is Read More »... Read more ›

- box,

- box home loans,

- box loans,

- credit repair,

- credit report,

- credit scores,

- delinquent payments on credit report,

- fico,

- financial health,

- fix my credit now,

- fixing my credit on my own,

- high credit score,

- home loans,

- how can i fix my credit,

- how can i fix my credit on my own,

- how can i repair my credit,

- improving your credit score,

- repair my credit,

- repair your credit

Temporary Leave Loan Qualification Temporary leave from an employer may encompass various circumstances (e.g. family and medical, short-term disability, maternity, other temporary leaves with or without pay). Under no circumstances should any medical documentation be required or any inquiry regarding the nature of the disability be made. Temporary leave may vary in duration. The period Read more ›

- applying for a home loan,

- box,

- box home loans,

- box mortgage,

- how do i qualify for a mortgage if i'm on temporary leave from work,

- loan application tips,

- loan qualification,

- mortgage company,

- qualify for a home loan,

- qualify for a loan while on temporary leave,

- temporary leave,

- temporary leave loan qualification

Why Mortgage Rates Fluctuate Mortgage interest rates fluctuate a bit differently than other, shorter term consumer loan rates. Credit cards, personal and auto loans typically fluctuate with lender cost of funds and prevailing short-term market rates. Mortgage rates change with the national economy strength or weakness, economic forecasts, Federal Reserve controls of the money supply Read more ›

- box home loans,

- box rates,

- economic growth,

- fed,

- fed adjusts rates,

- fed and money supply,

- federal reserve,

- lender competition,

- lenders,

- libor,

- long term economic growth,

- long term rates,

- market forecasts,

- money circulation,

- money policy,

- mortgage interest rates,

- mortgage lenders,

- mortgage rates,

- rate predictions,

- rates,

- rates in the future,

- short term rates,

- stay ahead of the curve,

- todays rates,

- why are interest rates always changing,

- why do rates change,

- why mortgage rates fluctuate

Take advantage of low interest rates In the 1980’s and 1990’s interest rates of 8-10% were commonplace. Over the years’ rates have dropped, and in 2012 we saw rates go as low as 3.35% and lower in some cases. What if you kept that rate of 10%, and never took advantage of the opportunity to Read More »... Read more ›

Warning: count(): Parameter must be an array or an object that implements Countable in /nas/content/live/boxhomeloans/wp-content/themes/box/home.php on line 62

Why Does My Lender Need to Document Everything? “What’s with all the documentation?” or “Aren’t my pay stubs enough? I make plenty of money and have more than enough assets!” Are common questions I hear from borrowers. You show us your paystubs, and then you get a mortgage, how great would that be?! We like Re... Read more ›

- box,

- box home loans,

- do i need id for a home loan,

- do i need id for a mortgage,

- home loan application process,

- homeowners insurance,

- income verification,

- mortgage application process,

- mortgage documents needed,

- pay stubs,

- proof of insurance,

- purchase agreement,

- what do i need to apply for a home loan,

- what will i need to apply for a mortgage

Does Box Home Loans accept disability income when qualifying for a loan? Yes! Here at Box Home Loans, we have the following verification requirements when using disability income: Verification of Disability Income We will need to verify the amount of disability payments that will be received from the benefit statement. Then determine how long the Read more ›

Instant quote I had been told before that getting a rate quote with companies other than Box Home Loans would be difficult. But I didn’t really understand what they meant until trying it for myself. I’m 22 years old and have a steady girlfriend, we’ve been thinking about marriage recently. Naturally, we thought about where Read More »... Read more ›